“UPI One World” wallet service extends to all* inbound international travelers

- It will also be made available for delegates attending the World Heritage Committee meeting in New Delhi from July 21-31, 2024

- UPI One World was issued to foreign nationals/NRIs from G20 countries last year

Mumbai, July 22, 2024: National Payments Corporation of India (NPCI) announced the rollout of ‘UPI One World’ wallet for inbound travelers, across all* nations of the world, visiting India. This initiative is designed to provide international visitors with a seamless, real-time digital payment experience, making it easier to explore India’s cultural wonders and vibrant landscapes. Additionally, this innovative service will be available to the esteemed delegates attending the World Heritage Committee meeting in New Delhi from July 21-31, 2024.

Through this development, delegates as well as other foreign visitors will have the opportunity to immerse themselves in India’s rich culture, cuisine, and many diverse experiences with the ease of Unified Payments Interface (UPI) payments.

UPI One World wallet, first introduced during the G20 summit hosted by India last year, will now be available to people visiting from many more countries. Foreign visitors can use the wallet to experience the convenience and security of the “made in India” technology. This eliminates the need to carry cash and the complexities of foreign exchange transactions.

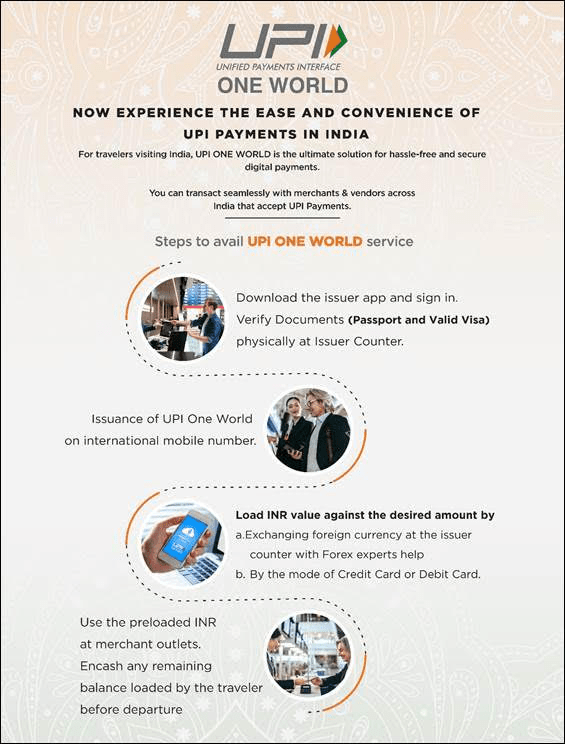

The UPI One World wallet can be availed through authorized PPI issuers at airports, hotels, designated money exchange locations and other touchpoints, following a full KYC process based on a passport and valid visa. Arrangements will also be made to make these wallets available at Bharat Mandapam in New Delhi, the venue of World Heritage Committee meeting, for the benefit of delegates. Once issued, the wallet can be loaded, either in cash or through other payment modes.

International travellers can use the UPI One World app to make payments at merchant locations by simply scanning the QR codes. Any unused balance can be transferred back to the original payment source, in accordance with foreign exchange regulations. This enablement has been made possible by the joint efforts of NPCI, IDFC First Bank, and Transcorp International Limited, under the guidance of the Reserve Bank of India.

Speaking on this significant development, NPCI spokesperson said, “We are thrilled to offer UPI experience to the international guests visiting India through UPI One World. This move aims to enhance the experience for visitors by equipping them with UPI, the most preferred payment choice among Indians. International travellers can organize their financial needs using UPI One World. It allows for convenient loading and enables the transfer of any unused balance back to the original payment source. By enabling foreign travellers to experience the real-time payments system developed by India, we are taking a significant stride towards creating a more interconnected global digital payments ecosystem.”

This initiative by NPCI showcases India’s leadership in the global digital payments landscape and provides an opportunity for the international community to engage with and benefit from India’s Digital Public Infrastructure (DPI) success story. Notably, in June 2024, UPI processed close to 14 billion transactions valued at INR 20.07 trillion (~USD 240 billion).

Some Countries excluded as per regulatory guidance.

About NPCI:

National Payments Corporation of India (NPCI) was incorporated in 2008 as an umbrella organization for operating retail payments and settlement systems in India. NPCI has created a robust payment and settlement infrastructure in the country. It has changed the way payments are made in India through a bouquet of retail payment products such as RuPay card, Immediate Payment Service (IMPS), Unified Payments Interface (UPI), Bharat Interface for Money (BHIM), Aadhaar Enabled Payment System (AePS), National Electronic Toll Collection (NETC) and Bharat BillPay.

NPCI is focused on bringing innovations in the retail payment systems through the use of technology and is relentlessly working to transform India into a digital economy. It is facilitating secure payment solutions with nationwide accessibility at minimal cost in furtherance of India’s aspiration to be a fully digital society.

For more information, visit: https://www.npci.org.in/